What to Do When You Win a Big Jackpot

First Steps to Check

Jackpot winners must enter a 24-48 hour review period just after they win. During this time, casino staff review video footage to confirm the win. Winners need to show various official IDs and fill out forms, with the key IRS Form W-2G for tax purposes.

Cash Options and Tax Impacts

Winners can pick from two ways to receive their prize:

- All at once: Typically 50-60% of the full jackpot amount

- Year by year: Distributed over 20-30 years

US taxes start at 24% for wins over $5,000, but state taxes vary up to 8.82% based on location. These taxes significantly affect the net winnings. https://maxpixels.net/

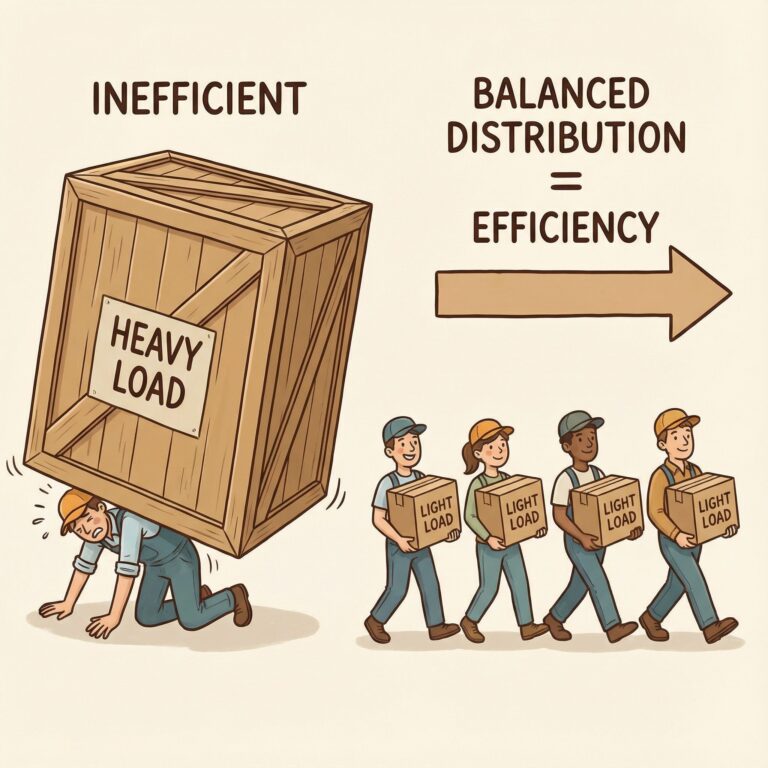

Plans for Long-Term Cash

Statistics show that 70% of jackpot winners encounter financial difficulties within five years. Smart financial planning can prevent insolvency. Consider:

- Professional financial assistance

- Diversified investments

- Budgeting strategies

- Asset protection measures

This strategic plan can help winners avoid common pitfalls and manage their large sums effectively.

How Casinos Ensure a Jackpot is Real

First Security Checks

Upon winning a big jackpot, the casino initiates a thorough review. The winner undergoes scrutiny by the casino’s security team, involving the presentation of multiple IDs and careful video analysis.

Checking Tech Steps

The casino’s tech team performs several essential checks:

- Reviewing game machine logs

- Ensuring the gameplay’s authenticity

- Assessing machine operations

- Analyzing the jackpot trigger

Watching the Videos

Security personnel review video footage to:

- Verify the player’s identity

- Ensure legitimate gameplay

- Confirm the absence of fraud

- Witness the precise winning moment

- Correlate player time with machine data

These measures ensure legitimate wins while safeguarding both casino and player interests through rigorous security processes.

How to Get Your Jackpot Cash: Full Guide

Understanding Payment Choices

Jackpot winners have two primary options to receive payment post-verification: all at once or spread over years. Each choice carries its own pros and cons.

All at Once

This option provides cash immediately, often amounting to 50-60% of the total jackpot due to:

- Immediate value adjustments

- Tax considerations

- Rapid cash access

Spreading It Over Years

Long-term disbursements spread the entire jackpot over 20-30 years, offering:

- Annual payments

- Full jackpot receipt

- Strategic financial management

How Payment Works and When

Casino payment policies adhere to strict standards and insurance requirements.

Key points include:

- Initiating payments within 90 days

- Annual installments on the anniversary of the win

- Predetermined payment structures

- Support from insurance agreements

Banks Helping Casinos

For prizes exceeding $1 million, casinos partner with banks to ensure payment security through:

- Special trust accounts

- Annuity purchases

- Guaranteed future payments

- Professional financial management

Smart Choices to Consider

Winners should evaluate various aspects when deciding on their payout method:

- Tax implications

- Investment opportunities

- Long-term financial planning

- Personal financial objectives

- Estate planning

The chosen payout method significantly influences future financial stability and wealth growth potential.

Understanding Casino Tax Obligations

Federal Tax Rules

Federal withholding begins at 24% for gambling wins above $5,000. Total tax liabilities can reach 37% or more, depending on tax bracket and residency.

Winners must report all gambling earnings on Form W-2G, provided by casinos for official tax documentation.

State Taxes

State withholding rates vary significantly:

- Nevada has no state tax withholdings

- New York taxes up to 8.82% on gambling wins

- Winners from other regions may face taxation in both the win location and their home state

Advanced Tax Planning Strategies

Professional tax advice is crucial for effective financial management. Key considerations include:

- Structured tax payments to avoid penalties

- Alternative Minimum Tax (AMT) considerations

- Documented gambling loss deductions

- Ensuring sufficient initial withholdings

Required Documentation for Casino Jackpot Claims

Essential ID Documentation

Official identification is necessary to claim a jackpot. Winners must present a valid photo ID and Social Security card for identity verification. The casino’s compliance team thoroughly reviews these documents before any significant disbursement.

Tax Documentation

IRS Form W-2G is essential for reporting gambling winnings and federal withholdings.

Non-U.S. residents must complete Form 1042-S. Casino-specific forms, such as internal jackpot claim forms, include:

- Personal identity information

- Preferred payment method

- State tax documentation

- Withholding preferences

Additional Required Documentation

Winners must also provide proof of residence, such as:

- Recent utility bills

- Valid lease agreements

- Bank statements

- Account details for fund transfers

Other Legal Considerations

Additional documentation may include:

- Notarized declarations for trust or business claims

- Liability waivers

- Non-disclosure agreements

- Documentation for loss deductions

Maintaining Records

It is crucial to retain all documentation for:

- Your tax records Arc-honed Casino

- Future reference

- Audit protection

- Regulatory compliance

All submitted documentation requires meticulous organization for verification by regulatory or tax authorities.